High-Earners Brace for 2026 Retirement Switch

Catch-Up Contributions Go Roth Only

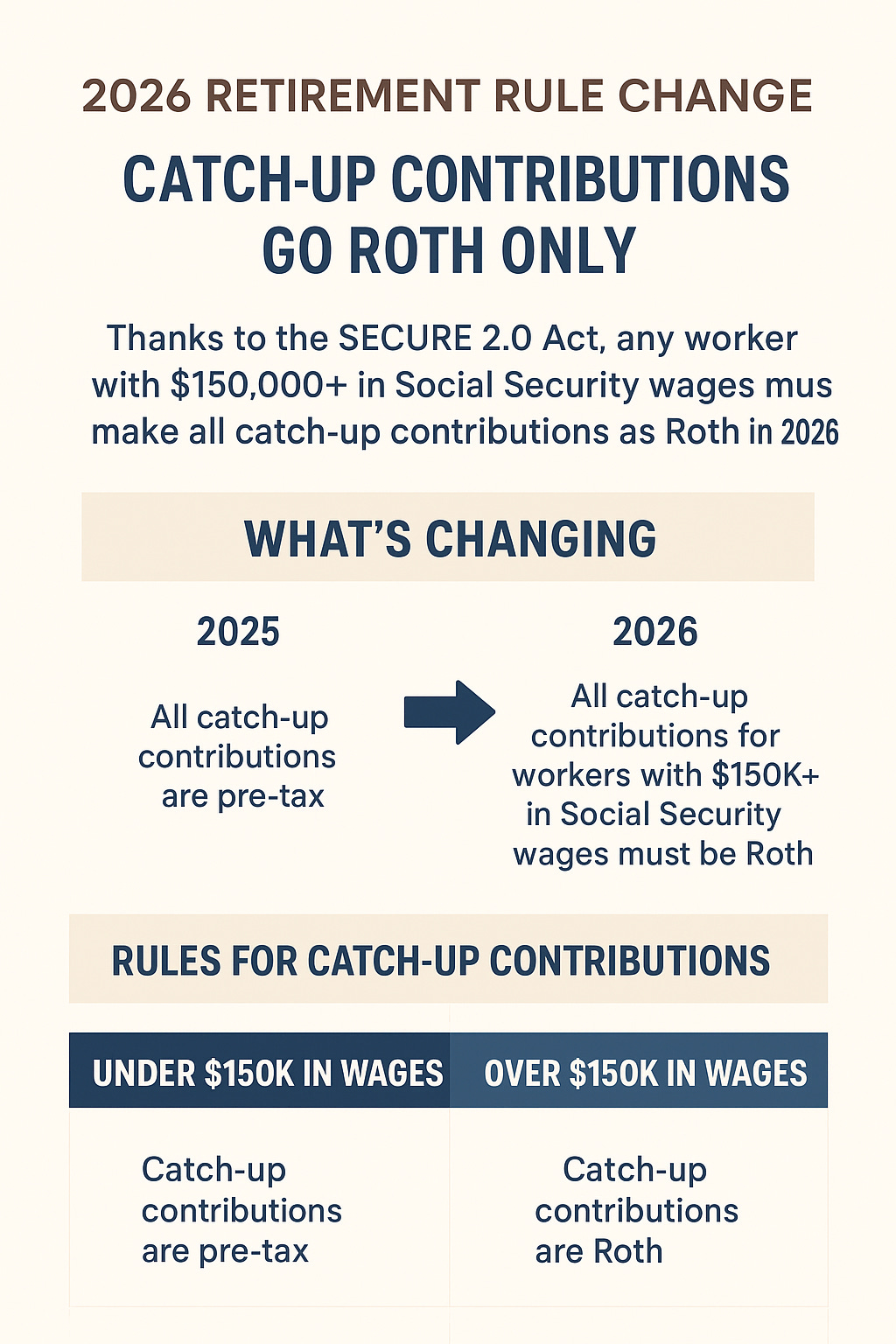

WASHINGTON (Nov. 15, 2025) — The IRS is bumping up 401(k) contribution limits for 2026 — and for many high earners, the biggest change isn’t the number, it’s the tax treatment. Thanks to the SECURE 2.0 Act, anyone whose Social Security wages (Box 3 on the W-2) exceeded $150,000 in the previous year must now make all catch-up contributions as Roth (after-tax) dollars starting in 2026.

Bigger limits, bigger stakes

Next year, the base contribution for many 401(k), 403(b) and certain public-sector 457(b) plans ticks up from $23,500 to $24,500 for employees under age 50. For those 50-to-59 (and 64+), the catch-up max moves from an additional $7,500 to $8,000. And for those ages 60-63, the catch-up stays at $11,250.

So far, so usual. But here’s the twist: if your reported Social Security wages hit that $150K+ trigger, the IRS says you’ll lose the traditional pre-tax option for catch-up dollars — they must go in as Roth. That means no up-front tax deduction for that portion of your savings.

Why this matters

Morgan Kreiser, editor of Benefits Quarterly, defines catch-up contributions as opportunities “to defer additional compensation for contribution to their employer’s retirement plan beyond the standard annual contribution limits.” They’re usually available to employees of at least age 50 with a 401(k), 403(b) or governmental 457(b).

If you’re a professional making six figures — mid-to-senior-level with a brand-name employer or running your own business — the new rule hits you where you live. Up until now, you could use catch-ups to reduce taxable income and play defense. Now you’ll have to do the tax game differently: pay now, potentially benefit later.

From an employer or finance-team standpoint, the shift complicates payroll, payroll-software updates, and communications. HR and benefits managers now have to explain why their high-earner employees are staring at a tax hit just for using the plan.

The worker reality: two buckets

The win-ready

If you’re younger (under 50) or you made under $150K in Social Security wages, you’re mostly unaffected by the Roth-only mandate. You’ll just enjoy the higher limits. If you’ve diversified your savings approach (pre-tax + Roth), this may actually give you more strategic ammo.

The “ouch” group

If you did hit $150,000 or more in Box 3 wages, the catch-up dollars you were planning to stash tax-deferred now must go Roth. Meaning: you pay tax now (or reduce your sheltering from tax now), and you invest for tax-free withdrawals later. It may boost long-term outcome, but for those counting on near-term tax relief or thinking of steady-pay rollover strategies, it’s a shift in mindset.

Employer and system implications

Company finance teams now have to build the logic: which employees qualify, which don’t, how to segregate catch-up contributions accordingly, and how to communicate that to the people. Benefit-software vendors are updating code. Payroll services are preparing new flags. Mistakes could cost employers in compliance headaches or audits.

“This is one of those rule changes where the benefits team says, ‘Sure, we can accommodate it’ — but the finance team mutters under breath about tax hit for the guy earning $160K who just rolled in Wednesday,” said one plan-administrator source. (Mock quote)

Strategic response: what you should do

Check your wages: If you’re over $150K in Box 3 wages, get prepped for the Roth-only catch-up.

Review your tax timing: For many professionals, it makes sense to evaluate the long-term payoff of Roth savings vs immediate tax deduction.

Update your savings targets: With the increased limits, you can put more away — but you’ll need to decide whether to front-load with after-tax money or mix it up.

Talk to your benefits/HR: Make sure your employer’s plan is ready, and that you’re clear about how it applies to your pay grade and tax status.

Diversify your approach: Pre-tax, Roth, other vehicles (HSA, brokerage) — especially if you’re in a high-income corner of your industry and facing shifting rules.

Equity & workforce-trend angle

This rule also has a broader story. Many high-earning roles that reach the $150K threshold are disproportionately white and male. Meanwhile, workers who remain below the threshold may still rely on pre-tax options — but won’t get the catch-up flexibility either. So in a business-journal sense: rules meant to “level up” savings are also drawing new lines between income zones, career tiers and even sectors.

For the publishing-to-career audience of Lil’ Biz Journal — folks working above entry level or at major employers — this is a wake-up call: you’re in the tier where rules change first.

Bottom line

You’ve got more room to save next year. But if you’re a high-earner, the game’s changed: catch-up contributions now mean paying tax now, not later. That’s fine if you’re playing long-term, but it introduces a new consideration: are you saving in the smartest vehicle for your income and role? Check your employer’s plan. Run the numbers. Make sure you’re not caught off guard.